👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. Join 45k+ readers from firms like a16z, Accel, Index, Sequoia, and more👇

Brought to you by Affinity - The Leading Deal Intelligence

Affinity surveyed close to 300 private-capital professionals, and the message is clear: AI has crossed from experimentation to strategy. The use of AI for investment decisions has more than doubled YoY, while firms simultaneously consolidated their data stacks to 1–3 core sources.

Our 2026 Predictions report outlines how private capital investors are leveraging these shifts to source faster, and stand out in competitive processes.

Happy New Year🎉

Now that 2025 is fully behind us, it’s worth pausing and reflecting before rushing into the next sprint. Not to recap everything that happened but to distill what actually mattered across AI, data, tech & tools for VC, and what I’m taking into 2026.

TL;DR: Subscribe to our new YouTube channel and join our free Slack group to automate your investor workflows (sourcing, screening, memos, notes, reach out, inbound etc.) with templates & step-by-step guides for tools like Claude Code, n8n, and more - starting for beginners without coding skills

⏮️ Looking Back ..

I launched this newsletter in September 2022 on Substack as a public experiment, sharing how I’m reshaping my work as a VC investor using data-driven approaches, AI, automation, and modern tools. The timing could not have been better with ChatGPT launching only two months later, quickly becoming a core theme across my experiments and making this hyper niche topic relevant for a broader investor audience. A way broader group than I had ever imagined..

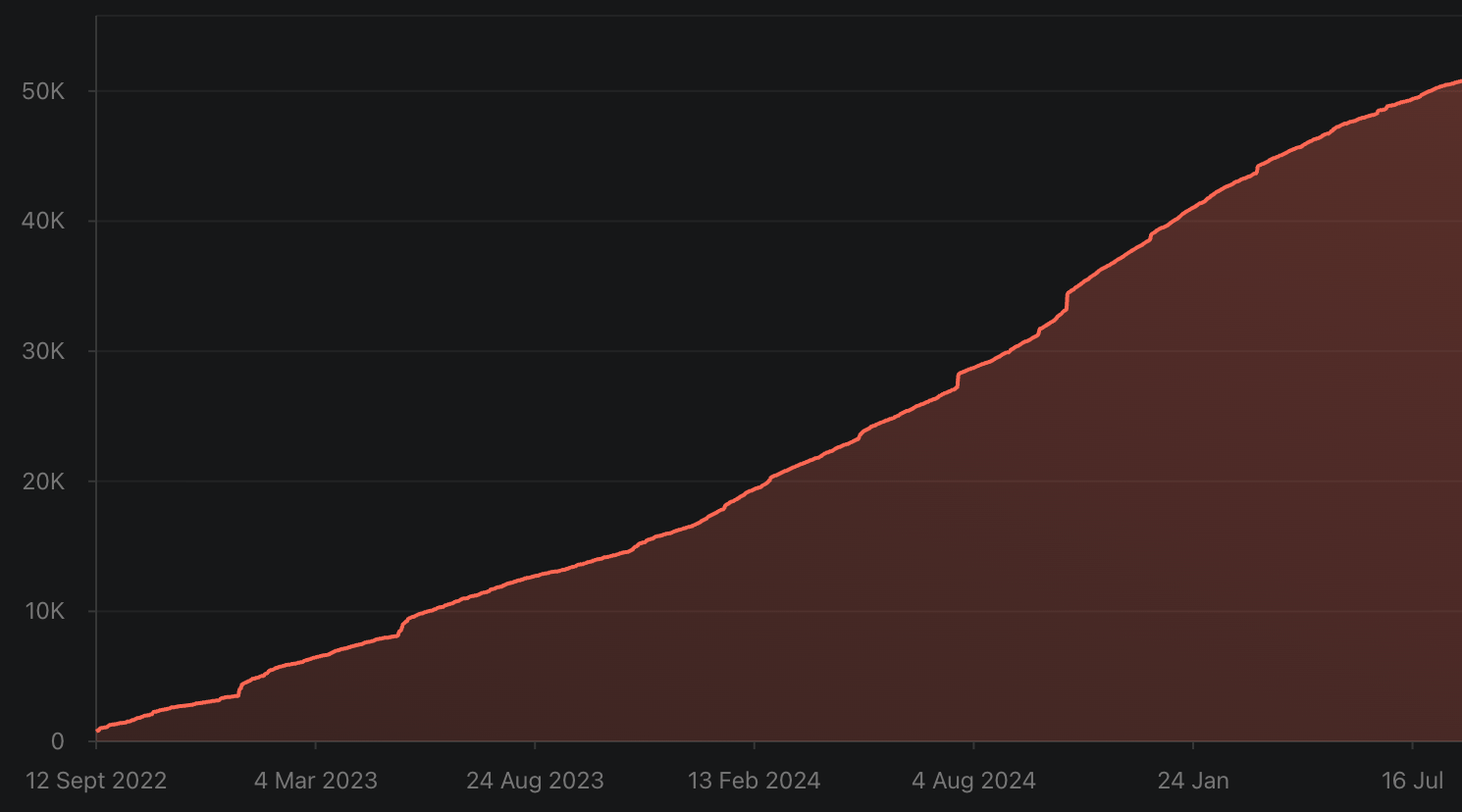

The subscriber numbers quickly hit 1k, 5k, 10k, 20k, 30k, 40k, and then 50k in July 2025, with many of you providing regular feedback and sharing inspirational ideas about how to take my experiments even further. While I started this newsletter on Substack, I got increasingly frustrated by the lack of insights, the closed nature of the platform (no API, no automations…), and the fact that they pushed my audience to download the Substack app and subscribe to my content there instead of simply signing up via email.

Turns out it’s more of a social media platform than a solution for content creators. Therefore, I migrated the newsletter from Substack to Beehiiv in September 2025 and, as part of a more comprehensive audience review, I decided to remove all subscribers who haven’t opened the newsletter in the past 90 days.

53k subs dropped to 35k, but at the same time the open rate massively improved from 38% to 59%. Snapshot of subscriber count, open rate, and CTR a few weeks after the migration below. Less noise, more signal. I’d always optimize for deep engagement and tangible value for few rather than vanity metrics such as high subscriber numbers.

With Beehiiv, I finally get deep insights about my audience and newsletter performance, can leverage their API, and automate various flows. Four months in, it was the best decision to move and I only regret having not migrated earlier.

What's your favourite DDVC newsletter format?

- Insights: research about successful STARTUPS

- Insights: research about successful VC FIRMS

- Essays: experiments & step-by-step guides (prompts, automations, etc.)

- Essays: tech stack & tool reviews

- Resources: Hottest startups of the month

- Resources: Multiples & state of the market

- Resources: Snapshots from The Lab

- Resources: What I read this week

On the foundation of three weekly newsletters (Tuesday “Insights” covering the most relevant research and reports of the past week, Thursday “Essays” sharing how I leverage data, AI & automations to automate my job, and Sunday “Resources” to share the most valuable resources from our community), I’ve also added new formats over the years to meet the ever-growing audience demand:

Reports: Achieved 5M+ social media impressions, 40k+ PDF downloads, multiple ProductHunt top 10 rankings, top tier media coverage across TechCrunch, Forbes, The Information, Business Insider, and more

Events: Hosted 150+ expert speakers and 8k+ participants across 30+ events.

2x Virtual Summit 2025 + 2024

2x Physical Summit in collaboration with Bits & Pretzels 2025 + 2024

20+ Virtual Roundtables + Meetups

10+ Physical Meetups across Munich, Berlin, London, and more

Products:

VCSTACK.COM as a library of all our resources such as automation templates, AI copilots, prompt libraries, Notion templates, browser plugins, document templates, contact lists, fundraising materials, and lots more

LIMITEDPARTNERLIST.COM as a dedicated spinout of our most sought-after contact lists (family offices, endowments, FoF, etc.) and fundraising materials

Fractional CTO / Automation Officer if you want to leverage the collective DDVC knowledge but don’t have the time to build it yourself, I’m happy to connect you to trusted partners who can help you

“The Lab” Community Platform: All our resources across newsletters, reports, event recordings, masterclasses, podcasts, products, and more in one place. Plus exclusive community meetups, AMA sessions, and Slack channel. All in one package, no extra hoops or paywalls

In short, the 5 pillars of DDVC today are 1) newsletters, 2) reports, 3) events, 4) products, and 5) “The Lab” platform.

Obviously, I haven’t built all of this myself but with the amazing support of Georgiy, Jerome, Lea, Christopher, Max, and many more. And because the bills need to get paid to keep the machine running and growing, I’m extremely grateful for the support from our 2025 partners Affinity, AlphaSense, Carta, DeckMatch, Eilla, Foresight, Harmonic, HSBC, Kruncher, MultiplesVC, Specter, Synaptic, and Vestberry, among others.

We have just opened sponsorship slots for 2026 and are excited to explore new partnerships. Just hit reply or submit your request here

As I’m reflecting on DDVC’s evolution, it becomes clear that this tiny little newsletter thing has become something like a startup project in itself. Investor by day, author and media operator by night. An accidental win-win that’s not only fun but helps me become better in the respective other discipline.

In my view, VC and media belong together like judgment and evidence. Just like judgment without evidence, VC without media is a commodity - as nicely framed by a16z as part of their New Media strategy few weeks ago.

Looking back at the DDVC journey, 2022-2024 was the phase of experimentation across content, formats, and tools. I treated the newsletter like my personal diary and the audience turned into a colourful mix of private market investors (angels, early/growth/multi-stage VCs, PEs, LPs, CVCs), startup founders & operators, researchers, and more.

What's your primary job?

Subsequently, 2025 was the phase of refocus where I took a step back, refined the foundation, analyzed which content and formats have performed well, where to double down and where to cut, and most importantly what DDVC’s true ICP looks like:

Private market investors who want to leverage modern tools, data, automation, and AI to launch and run their investment firms at scale - essentially just like myself.

With this in mind, 2026 will be all about ..

Access all our premium content + join the Data Driven VC community

.. Looking Ahead ⏭️

Scale. With refined clarity on DDVC’s ICP and value prop, 2026 will be about consistently improving existing core formats (newsletters, reports, events) and heavily doubling down on:

“VC Tool Finder”: I launched VC Tool Finder in closed beta for “The Lab” Premium members last year to compare their tool stacks with peers, review solutions, see how much others pay, and claim vendor discounts. The first version wasn’t perfect but has confirmed a strong need for the value prop and, most importantly, we’ve collected tremendous amount of feedback to ship the next version for “The Lab” members soon

“The Lab” Community Platform: The value of our community platform keeps compounding every day as we add fresh newsletter episodes, reports, products, and recordings from our conferences, roundtables, and masterclasses - and as our AI copilot consumes all of it to get smarter and provide tailored answers to your questions. Same holds for our community where the more committed members we have, the higher the value for other members becomes. We have quickly surpassed 150 members and will do everything we can to maximize value and foster meaningful connections among like-minded peers. Join us here

In addition, we’ll add new formats:

“VC Automation Experiment”: I just launched this free Slack group where I’ll share live experiments and step-by-step guides of automating my VC job end-to-end. We discuss the best tools for specific tasks, share experiences and templates, and brainstorm ideas. Make sure to join the group to get all details

DDVC YouTube Channel: I found that text is not always the best format for DDVC topics, specifically the more technical step-by-step guides, tool reviews, and workflow automations. Therefore, I just launched a YT channel to complement the VC Automation Experiment and expand into adjacent areas over time. Make sure to hit subscribe to never miss an update

I truly believe that with the AI tools available to all of us today, we can automate the majority of our tasks as investors and focus our freed up time on what really matters: Human connections and complex decisions. Two areas where AI likely won’t succeed anytime soon.

With that, let’s rock 2026! Wishing you all a healthy and successful start.

Stay driven,

Andre