👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts, and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 16,550, +200 since last week

Brought to you by Harmonic - The Sourcing Tool for Data-driven VCs

Harmonic is the startup discovery tool trusted by VCs and sales teams in search of breakout companies. Accel, YC, Brex, and hundreds more use Harmonic to:

Discover new startups in any sector, geography, or stage including stealth

Track companies’ performance with insights on fundraising, hiring, web traffic, and more

Monitor their networks for the next generation of foundersFind Your Next Deal With Harmonic

The period between Christmas and New Year's Eve is ideal for introspection. It's a time to step back, review the past, acknowledge achievements, and thoughtfully prepare for the future.

While I usually prefer to contemplate on my own, the decision to launch this newsletter as a “building in public” project has led me to use this year-end edition for a transparent reflection.

As stated in my first episode on “what to expect from this newsletter” published on 11th Sept 2022 “Together with an ever-growing group of like-minded people, I made it my mission to push VC to the next level through real innovation. To overcome shortcomings from inaccessibility for underrepresented founders over biased, inefficient and manual decision-making processes to non-scalable, sometimes very limited value-add. I strongly believe that technology in general, but data & AI more specifically, are here to disrupt VC as it did/does with any other industry.”

Referring to episode 14 on “how VCs can learn from each other”: “Very few people are actually in the position to share hands-on learnings, what works well, what doesn’t work and where they get their information from. And those who do, are oftentimes not willing to share their perspectives because they’re afraid to lose their edge. As a result, the ecosystem is not only very early but also highly fragmented with a strong reluctance to share learnings. This is also why most researchers struggle. They lack the hands-on insights from practitioners who are in the trenches. Therefore, a close researcher-VC relationship is key to generate useful studies. This newsletter is here to change this dynamic and provide a platform for like-minded people.”

Building in Public

VC is a privileged and intransparent industry where not only returns (=output) follow a Power-law distribution but also the allocation (=input) is very much concentrated. A few hundred to a thousand Partners globally decide, oftentimes behind closed doors, how hundreds of billions of $$ get invested. It's the minority of the people moving around the majority of the money.

While some VCs share their decision-making processes and selection criteria publicly, the majority keep their inner workings to themselves and build in the dark. As a result, opacity perpetuates. Opposing this trend, I decided not only to openly speak about and create a platform for modern, digital-first VCs but also to build in public by sharing all the ups and downs associated with it.

Every newsletter starts with the recent number of subscribers and the growth within the prior week. Moreover, I take specific milestones to include learnings on the process of writing this newsletter and growing the community. Just like this episode.

The Community

I’ve been actively writing and sharing professional content for about seven years. On the content creation side, I wrote 3 academic papers with about 8k downloads and 12 Medium blog posts with about 100k reads before I joined Substack for more structured writing in September 2022.

Since then, I published 81 episodes: 66 deep dive pieces and 15 monthly wrap-ups. Moreover, I launched the first episode of the “Data-driven VC Landscape”.

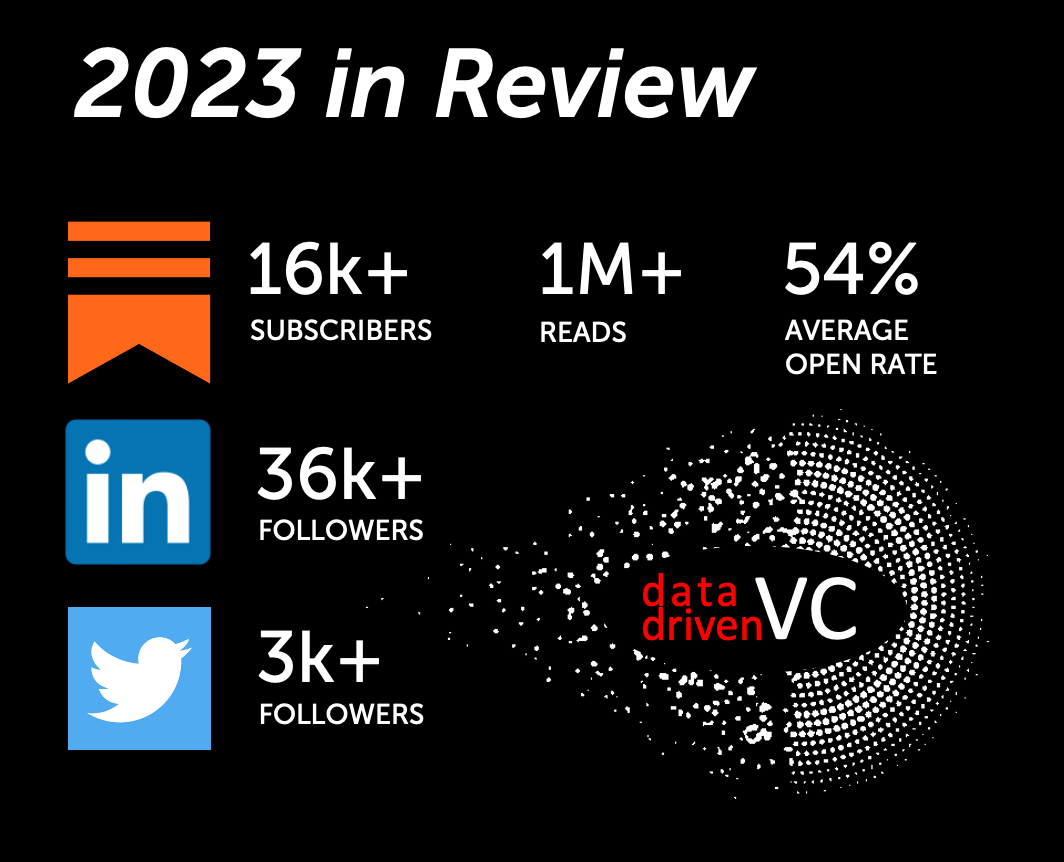

Let’s look at the metrics in more detail:

Sources of traffic: This newsletter got read 1,008,954 (1 MILLION 🤯) times in the past year. Most traffic came via the email distribution list (772,078 views), directly by typing in the URL (150,827 views - #brandrecognition), via LinkedIn (34,813 views), via Google search (23,091 readers - #SEO, more below), and via Substack itself (9,333), see details here. For me, the most underestimated source has been Google search. Until March 2023, I hosted the newsletter on the Substack subdomain datadrivenvc.substack.com and didn’t care too much about search traffic. Thankfully, my friend from highlighted the importance of owning search traffic via Google and pushing SEO, so I registered and migrated the newsletter to datadrivenvc.io. Within 9 months, Google generated 390k search impressions, 23k reads, and converted 1k subscribers.Other sources include signups via the Data-driven VC Landscape report, Reddit, Twitter/X, Podcasts, Media Coverage (Sifted, Business Insider, etc.), and Substack recommendations. On this note, a big shoutout to my top 3 recommenders from , from , and & from who collectively guided 950 new subscribers my way. You guys rock, thank you so much 🙏🏻

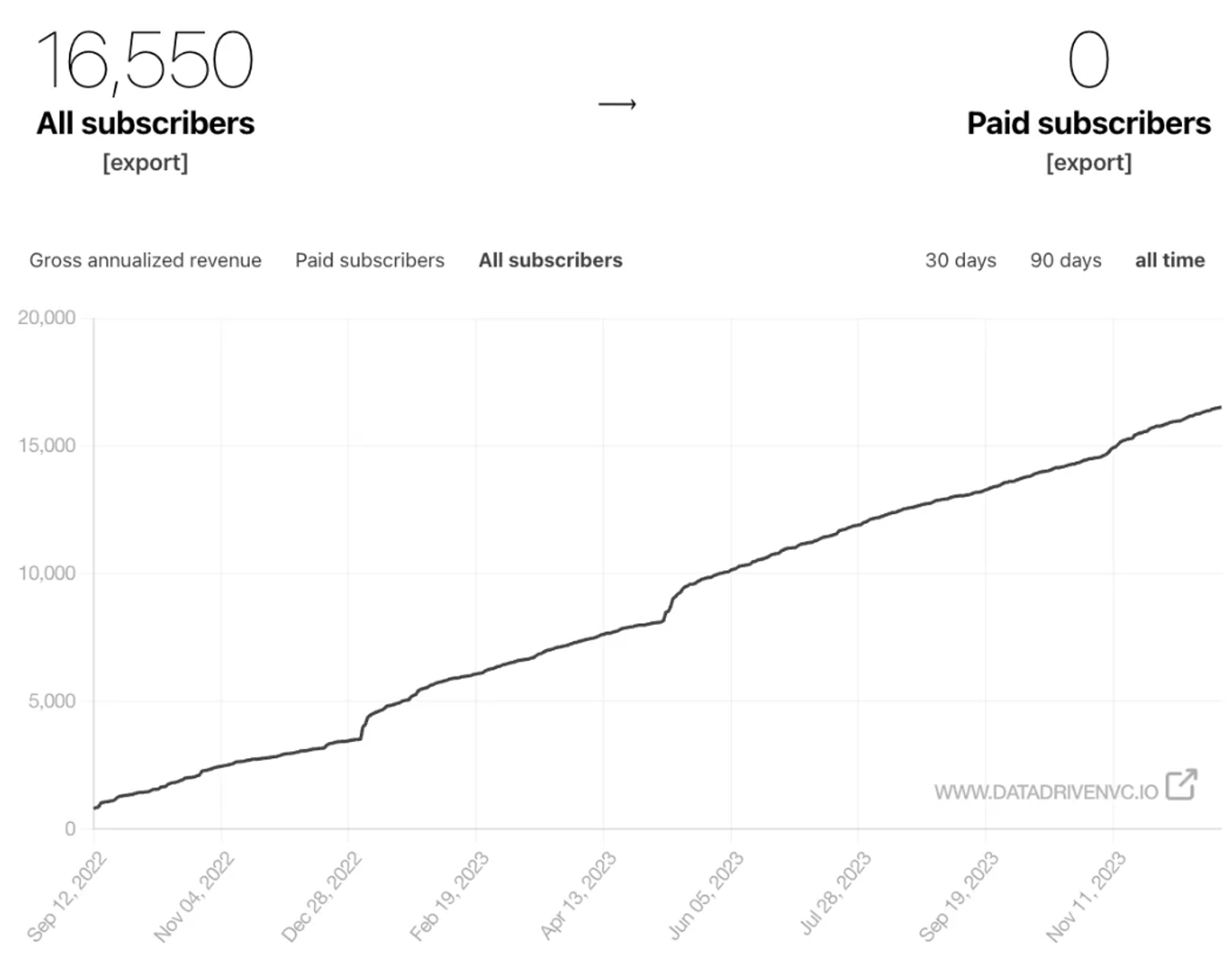

Subscriber numbers: 5x annual growth and 16,550 like-minded subscribers as of today. Overall, subscriber growth has been pretty consistent with an average of about 250 new subscribers per week or about 1k per month. Different from VC as an asset class, the newsletter game is base hits over home runs. Consistency is key.The three spikes in 2023 were driven by two well-performing episodes (Jan 2023 + Nov 2023) and the launch of the Data-driven VC Landscape 2023 (May 2023). Yes, there is room for improvement on the distribution side of the newsletter but I want to keep my social media channels as high quality and low noise as possible. So for the moment: 1 LinkedIn and 1 Twitter post per Data-driven VC episode.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other subscriber-only content.

Join the Community